News

Downtown Seattle dying? Not so fast. Demand for office space roars back to pre-pandemic levels

Posted on

This story was originally published in The Seattle Times on May 3, 2021

At the beginning of February, I wrote about what seemed like a troubling sign for the future of downtown Seattle.

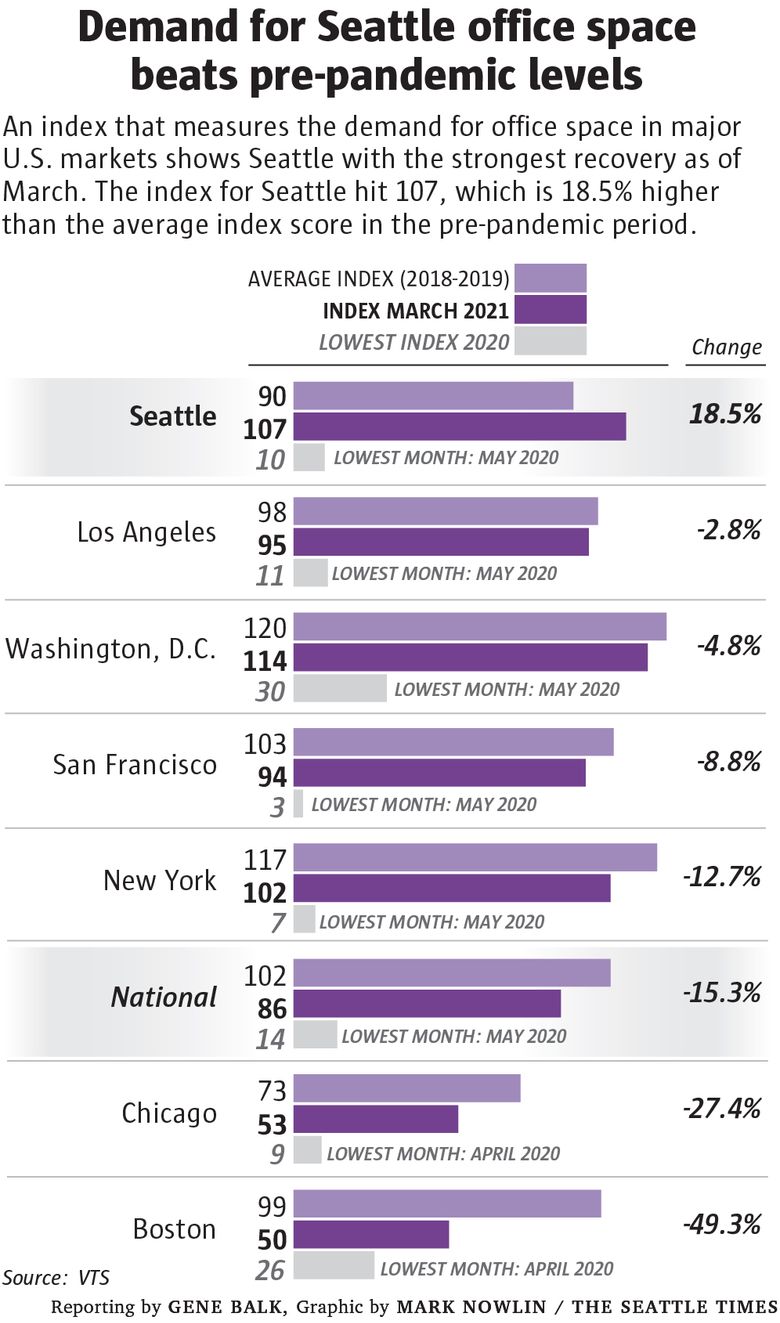

An index that measures the demand among companies for leasing new office space showed that in December, the Seattle market had experienced the biggest drop in the nation since the start of the pandemic — and that happened despite the fact that our office-using employment numbers had fully recovered.

What a difference a few months can make.

That same index now shows that demand for office space in the Seattle market has come roaring back since the beginning of the year, surpassing pre-pandemic levels.

New York-based VTS, which provides leasing and asset management software for commercial real estate landlords, has produced this index number for major markets since January 2018 — the level of interest in new office space in that month was set as an index score of 100 for each market.

From 2018 to 2019, Seattle had an average monthly index score of 90. That, of course, was before the pandemic had closed down offices, requiring millions of employees to work from home. By December 2020, Seattle’s index number had plummeted to a dismal 17, which prompted me to write my earlier column.

But in 2021, Seattle has experienced a tremendous rebound, with interest in new office space growing each month. As of March, the index for interest in office space had shot past the pre-pandemic average, hitting 107.

“There can be a dramatic effect when you’re combining some of the pent-up demand for office tenants to return to the market with an improving employment situation,” said Eli Gilbert, head of market research for VTS. “The growth of the employment base in Seattle is the highest among the core markets.”

And of course, the rebound couldn’t have happened without the rollout of the COVID-19 vaccines.

“A lot of tenants are starting to see the light at the end of the tunnel,” Gilbert said. “They want to at least begin the space-search process, which can take months if not quarters before it turns into a signed lease.”

The turnaround in demand for new office space in Seattle is so dramatic that I felt I should follow up on this story. And frankly, I may have been too alarmist in my earlier column — though, in my defense, I did note that December’s rock-bottom index number might simply represent a brief lag between the hiring of new workers and the leasing of office space, and not a long-term trend away from physical offices.

I also noted that the low interest for office space in our market in December could have been because our dominant industry — tech — had adapted better than other industries to a remote work environment. Tech firms could afford to take a wait-and-see approach to returning to offices, I wrote.

And to some degree, that appears to be true. According to VTS, while the demand for new office space among Seattle tech companies has greatly improved in 2021, it’s still well below the levels seen before the pandemic. But a surge in interest in office space from other major industries in Seattle — health care, legal and professional services — has made up for that.

The VTS index is an early indicator of interest in new office space. It captures, for example, the number of office-space tours by potential tenants. Tours are important because that’s how a company first engages the market, but it’s important to note that the index does not capture signed leases or move-ins.

After my earlier column was published, I heard from scores of readers — some of them quite annoyed with me — for not pointing out what they felt was the obvious: that the demand for office space had nosedived because of the months of protests and property destruction, and the crisis of homelessness in downtown Seattle, which is, of course, the largest concentration of office space in our market area.

It’s true that some companies have left downtown citing problems such as concern over employee safety. And certainly, these concerns should not be dismissed.

I asked Gilbert about this, in relation to the remarkable rebound we’re now seeing in demand for office space in Seattle.

“Companies know where the talent is, and where people want to be,” he said. “There are reasons that companies want to be in Seattle, and quite frankly, a couple months of protests isn’t going to change decades of attractiveness for office.”

There is always going to be the “downtown sucks” crowd, he added — those people who don’t care for urban spaces and who focus exclusively on the problems.

But Gilbert says the fundamentals of the Seattle market are solid and expects the strong demand for office space to continue. However, there does remain the possibility of a resurgence of COVID-19 cases, which could set things back.

Most other major markets in VTS’ report also rebounded, but only Seattle exceeded the pre-pandemic average. Los Angeles, Washington, D.C., and San Francisco came pretty close. New York and Chicago showed decent recoveries, but Boston was still down 49% from its pre-pandemic average.